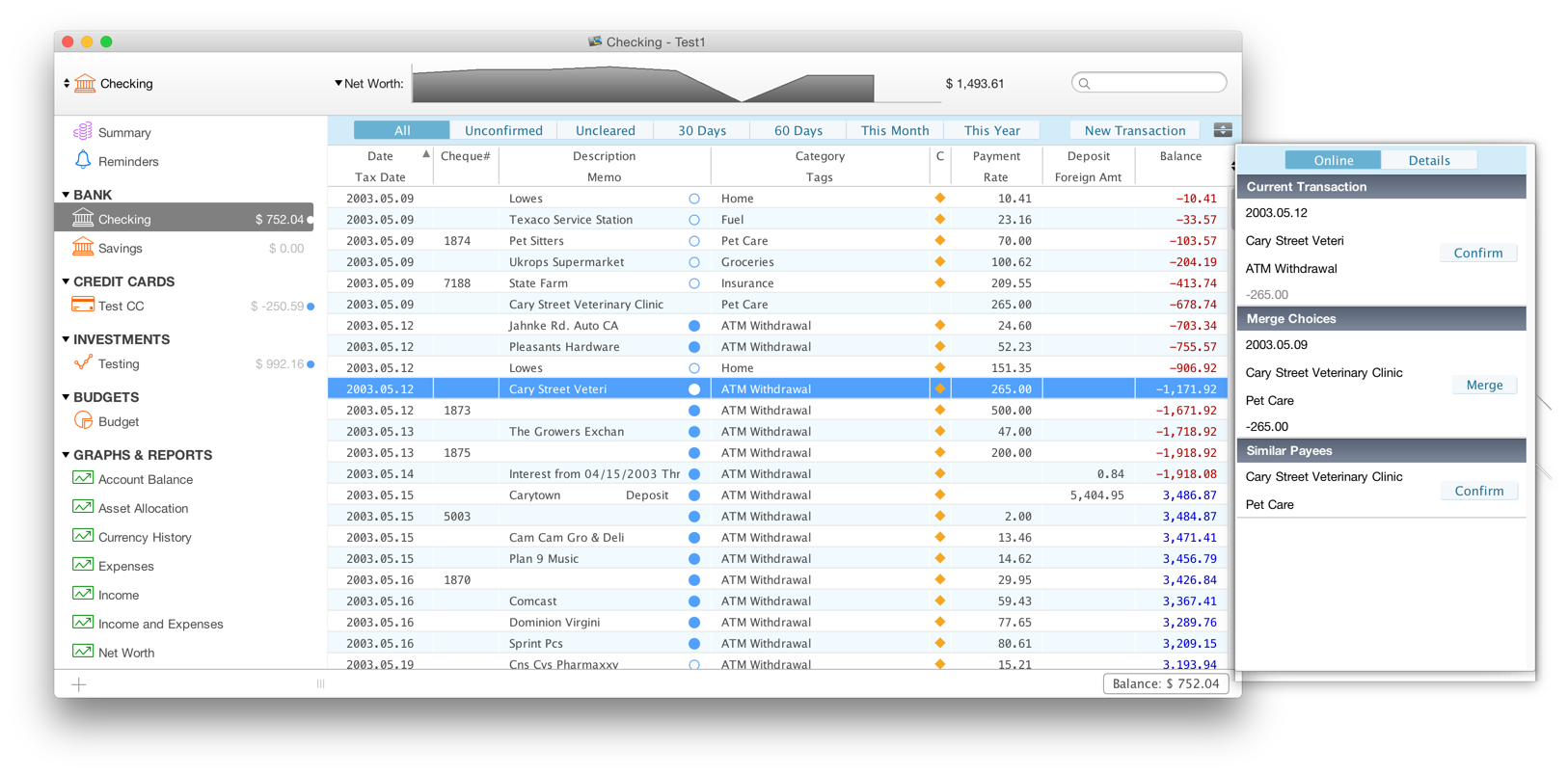

This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). I concur with MacWorld’s iBank review, iBank offers best in class money management for Macs, but it charges accordingly.Īdvertiser Disclosure: The offers that appear on this site are from companies from which MoneyUnder30 receives compensation. If you want iBank to sync your accounts automatically you’ll need to purchase a “Direct Access” subscription that runs $5 a month, $13 a quarter, or $40 a year. The Mac version is $60 and the elegant iBank mobile apps are an additional $20 for iPad or $5 for iPhone. That’s good news if you want to import your transactions manually rather than linking your bank accounts. IBank handles imports especially well it’s easy to import data from Quicken or your financial institutions in a variety of formats (QIF, CSV, OFX to name a few). IBank also includes portfolio tools that let you see trades, positions, and unrealized gains in one place across all of your investing accounts. It helps with your budgeting by enabling you to schedule income and bills and set budgeting targets. IBank excels at financial software’s biggest mission: categorizing transactions and summarizing spending. I was able to set up my three bank accounts, two credit cards and half-dozen investment accounts in about 20 minutes. But users lamented that software’s clumsiness, especially on Macs.

We’ve been tracking numerous budgeting Websites and apps since Money Under 30 launched in 2006, and there are some good options (some free) if you don’t mind logging into a Web app.īut even in today’s connected world, there’s something comforting about a personal finance application that lives on your computer.įor years, that go-to app was Quicken. If you’re a Mac user looking for full-featured software to automatically aggregate your bank accounts, track your spending, and manage your investments, your search may be over with iBank.

Understanding Overdraft Protection and Fees.Balance Transfer Calculator: How much can you save?.Credit Score Calculator: Get Your Estimated Credit Score Range.

0 kommentar(er)

0 kommentar(er)